MFW Fiałek advises PZU Zdrowie S.A. on the acquisition of shares in Humana Medica OMEDA sp. z o.o.

Our advice

Our comprehensive advisory services included structuring the transaction, conducting due diligence, preparing and negotiating transaction documentation, accompanying documentation (including documentation concerning real estate and the continuation of the founders’ cooperation with the company) and closing the transaction.

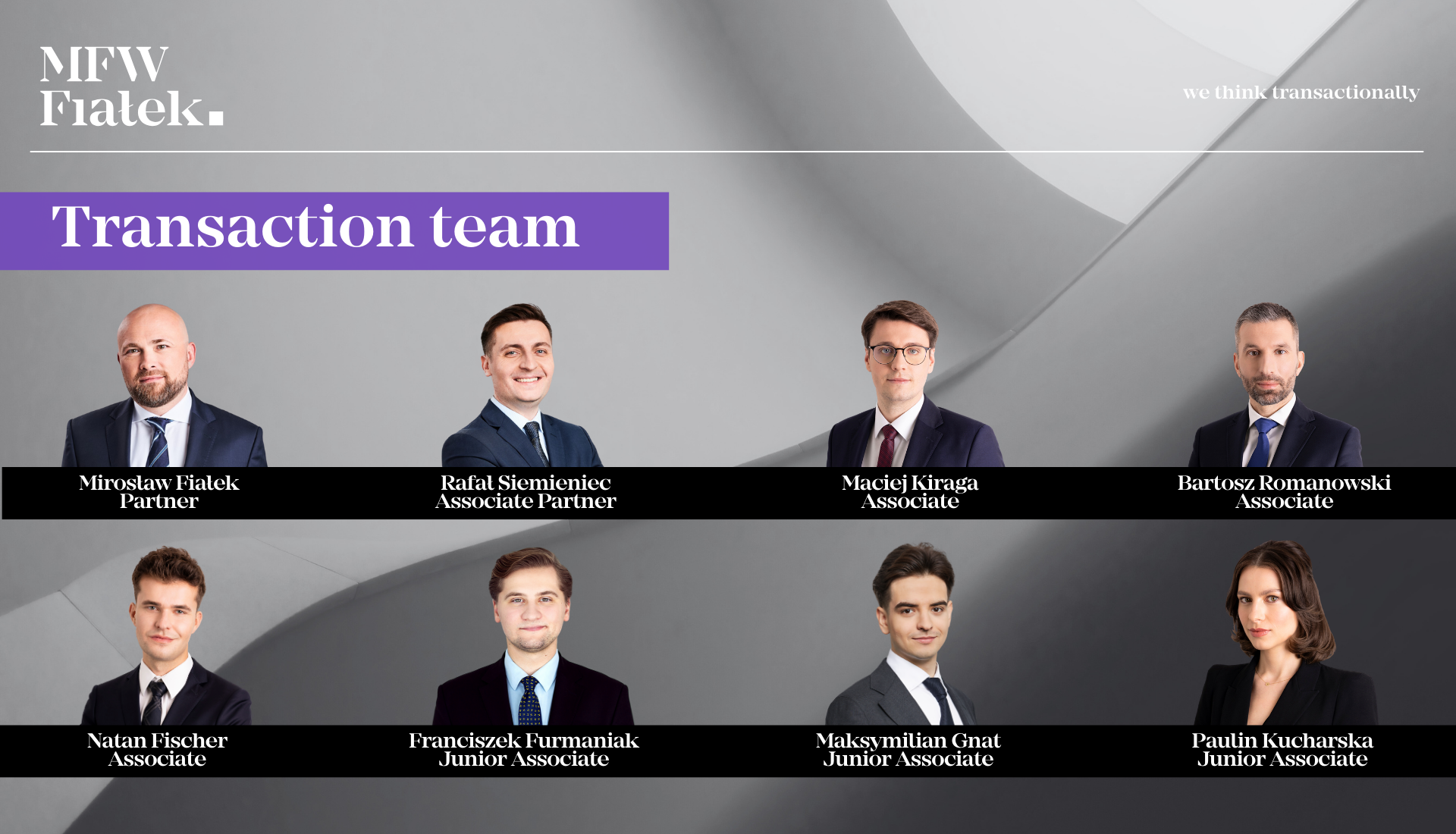

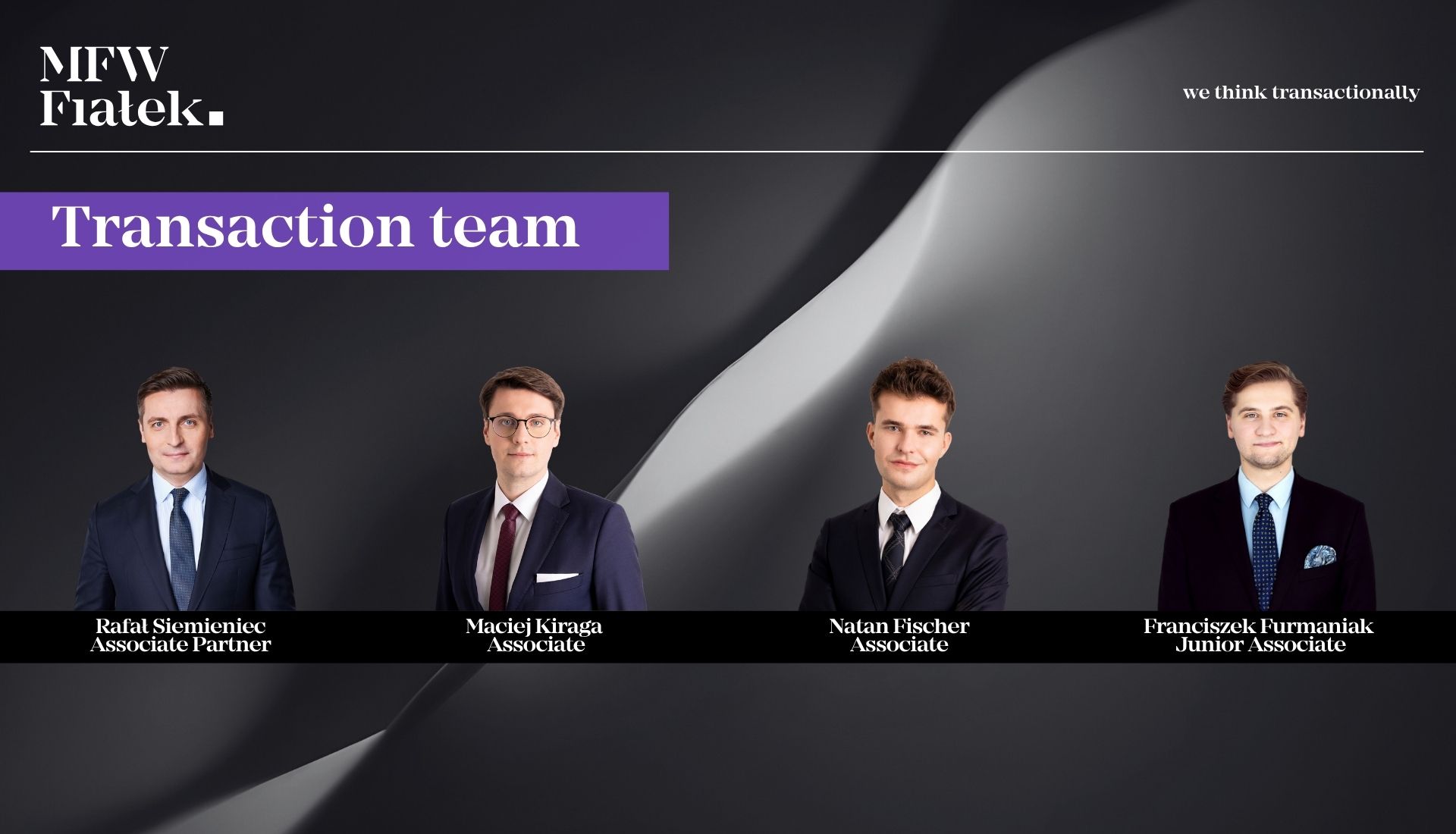

MFW Fiałek project team

The team was led by Mirosław Fiałek – Partner, and Rafał Siemieniec – Associate Partner. The transaction team also included Maciej Kiraga – Associate, and Franciszek Furmaniak – Associate. The due diligence team additionally included Bartosz Romanowski – Associate, Natan Fischer – Associate, Paulina Kucharska – Junior Associate, and Maksymilian Gnat – Junior Associate.

Transaction parties

PZU Zdrowie S.A. is one of the largest medical networks in Poland, comprising its own and partner facilities throughout the country. The company provides services in the field of primary health care, specialist consultations, diagnostic imaging, rehabilitation and outpatient care.

Humana Medica OMEDA is a private medical centre and specialist hospital operating on a surgical and treatment model. The facility offers specialist consultations, diagnostics and full surgical facilities. It specialises primarily in general surgery, orthopaedics, plastic surgery, vascular surgery, as well as ENT, proctology and urology. The hospital provides modern operating theatres, an experienced team of doctors and comprehensive pre- and post-operative care.