MFW Fiałek Law Firm advised Hartenberg Capital on the acquisition of a controlling stake in the 4Kraft sp. z o.o. and its subsidiaries, i.e. 4Kraft LLC and Suzhou Kinderkraft Trading Co., Ltd.

The transaction was conducted through enterstore, a holding entity under which Hartenberg consolidates its e-commerce investments across various countries.

Our advice

Our advisory services included comprehensive handling of the transaction, including conducting due diligence, preparing and negotiating transaction documentation, supporting the signing of the transaction and coordinating works carried out by the Zhong Lun Law Firm, China counsel for the transaction. The scope of work also included matters governed by German and US law.

Additionally, we represent the client in the proceedings before the UOKiK. The closing of the transaction depends, among other things, on the approval of the President of the Office of Competition and Consumer Protection for the concentration.

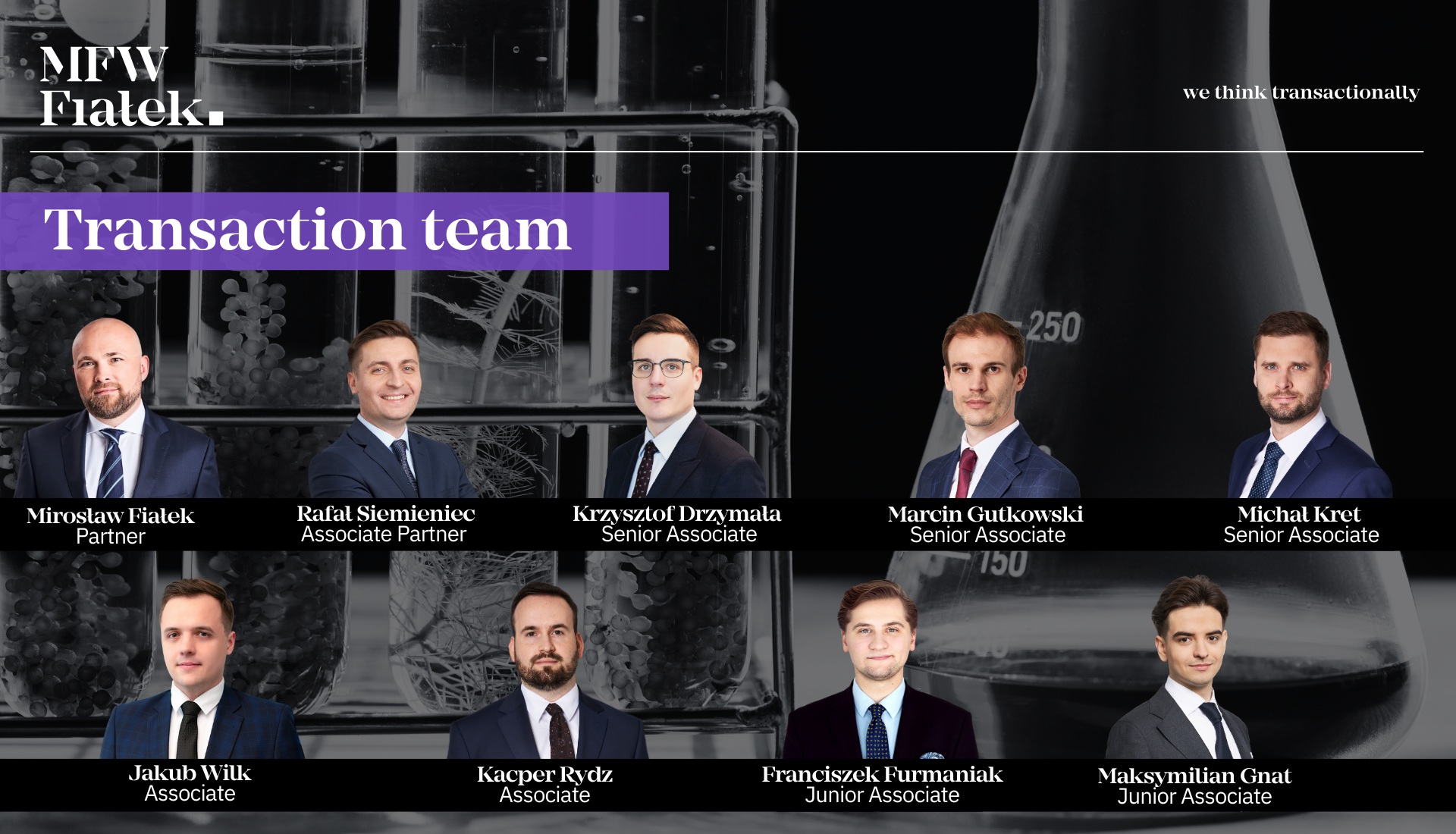

The transaction team was led by Mirosław Fiałek – Partner, Mariusz Domagała – Senior Associate, and Krzysztof Drzymała – Senior Associate.

In addition, the due diligence team consisted of Michał Kret – Senior Associate, Marcin Gutkowski – Senior Associate, Paweł Siwiec – Senior Associate, Wojciech Lichterowicz – Associate, Kacper Rydz – Associate, Jakub Wilk – Associate, Franciszek Furmaniak – Junior Associate, Maksymilian Gnat – Junior Associate, and Robert Szumiłowski – Intern.

Parties of the transaction

Hartenberg Holding is a 300 million EUR investment fund focused on investments in companies in the Central European Region, primarily Czech Republic, Slovakia and Poland. Hartenberg Capital is the General Partner and Administrator for Hartenberg Holding. Hartenberg Capital manages the fund’s assets, seeks investment candidates, executes investment transactions, implements and manages the investment strategies in collaboration with company management and potentially exits investments made by Hartenberg Holding.

4Kraft Sp. z o.o. is one of the fastest growing global manufacturers in the children products sector. The company distributes its products mainly in e-commerce channels using B2B and B2C models and in traditional sales channels. The company has been operating since 2011 and systematically strives to take its position among leaders in the children products industry. 4Kraft is the owner of the Kinderkraft and Kiddy brands. Products of these brands are available across Europe, Asia and Australia with expansion plans to North America and Africa.