MFW Fiałek advised the owners of Zakład Przetwórstwa Owocowo-Warzywnego “ROLFROZ” sp. z o.o. on the sale of 100% of the shares to Cedo Capital. The deal ranks among the largest search-fund transactions in Europe to date.

Our M&A advice

Our support covered all stages of the M&A transaction – from assistance in the due diligence process to drafting and negotiating the SPA, advisory agreements, real estate sale agreements, and the remaining transaction documentation through closing. The deal ranks among the largest search fund transactions in Europe to date.

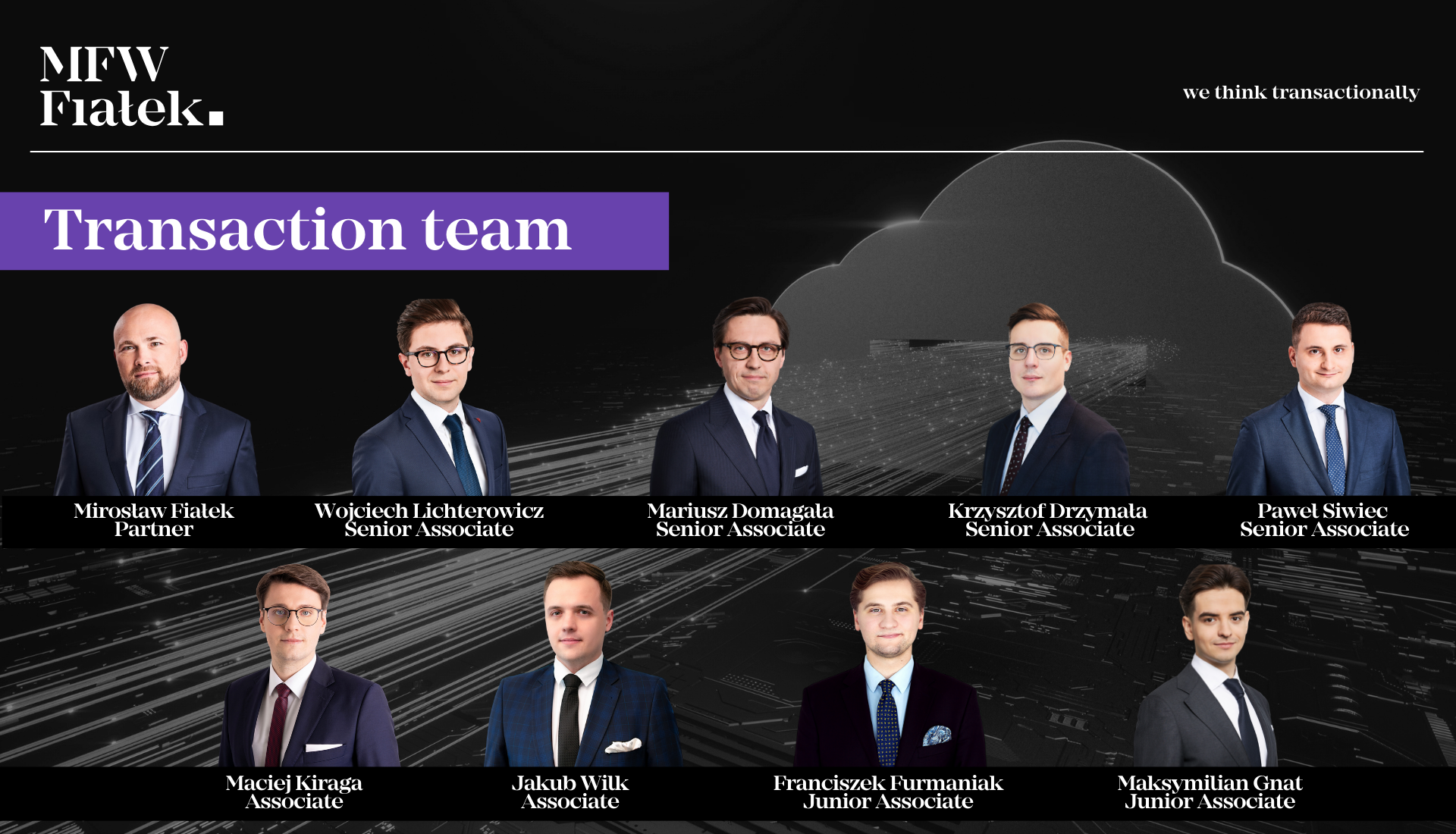

MFW Fiałek project team

The team was led by Mirosław Fiałek – Partner, with legal support also provided by Wojciech Lichterowicz – Senior Associate and Maciej Kiraga – Associate. The team further included Franciszek Furmaniak – Junior Associate and Maksymilian Gnat – Junior Associate.

Transaction parties — sellers and buyer (search fund)

ROLFROZ is a family-owned company built on tradition and commitment. For over 30 years, it has been one of Poland’s leading producers of sterilized and salad vegetables, vegetable and fruit concentrates and purées, as well as pickled vegetables for the food industry.

Cedo Capital is a project founded by entrepreneurs, experienced managers, and trusted investors. Its mission was to identify and acquire Polish SMEs with a solid track record and significant growth potential. The fund is led by Founder and Managing Partner Monika Wincel, supported by an international group of search fund investors from Poland, the USA, Mexico, Australia, Spain, Germany, and Belgium.

Planning a transaction?