MFW Fiałek advised Develia S.A. on the signing of an annex to the joint venture agreement with Grupo Lar Polska.

The signing of an annex to the joint venture agreement with Grupo Lar, a Spanish investor and developer, aims to extend the existing cooperation between both developers to include the development of another residential project, this time in Warsaw’s Praga district. The residential project involves the construction of approximately 550-600 flats.

The cooperation has so far included two projects Ursynów#22 and Lizbońska, with a third investment in Białołęka currently in preparation. The implementation of the new investment is subject to the conditions of the real estate acquisition and the approval of UOKiK.

Our advice

Our advisory services in relation to the execution of the annex to the joint venture agreement include comprehensive support for Develia, in particular with regard to the transaction documentation as well as the drafting of the application and proceedings by the UOKIK.

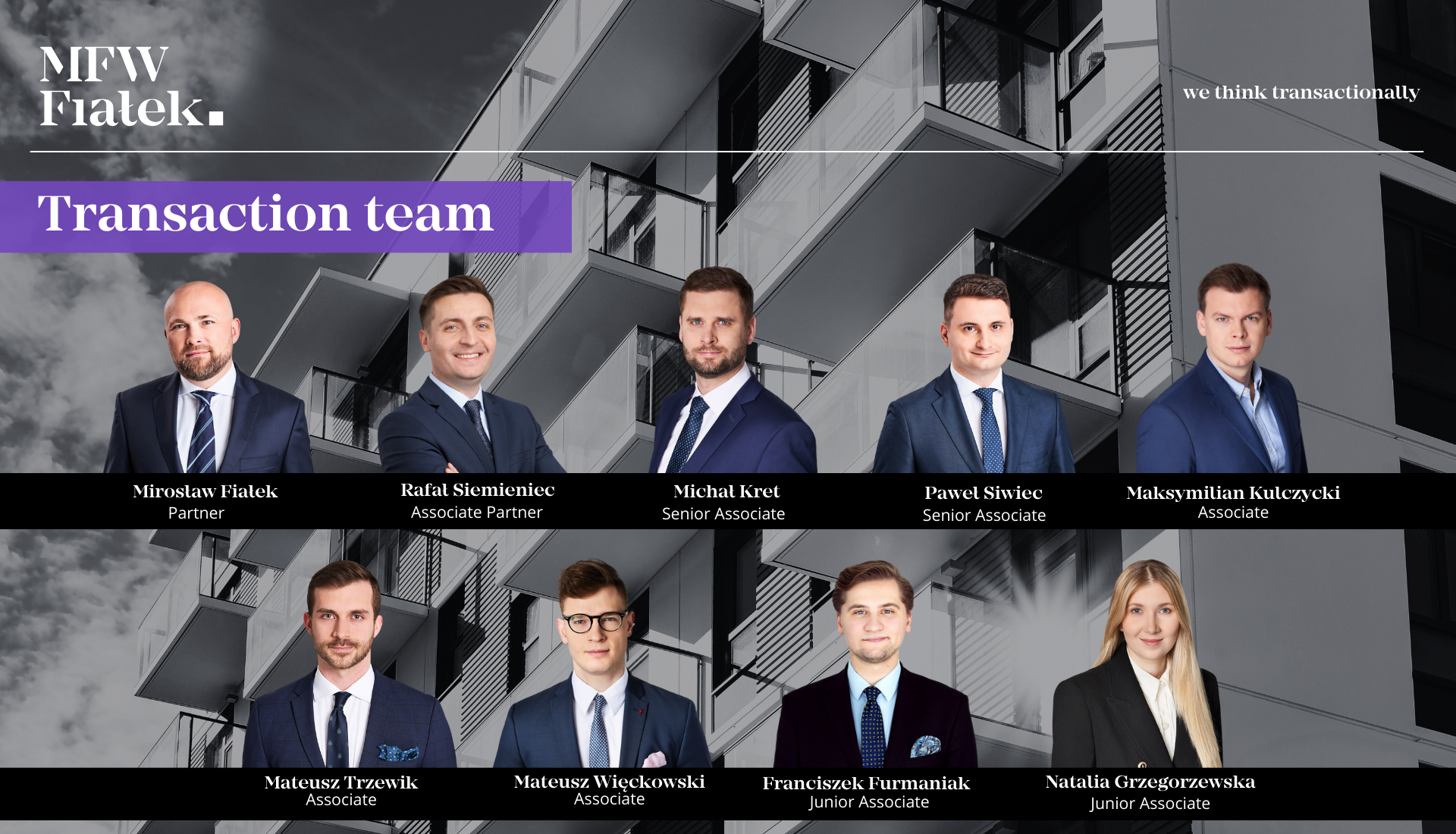

The transaction team consisted of Mirosław Fiałek – Partner and Rafał Siemieniec – Associate Partner, Paweł Siwiec – Senior Associate and Mateusz Trzewik – Associate.

Parties of the transaction

Develia S.A. is one of the leading development groups in Poland, listed on the Warsaw Stock Exchange. The group carries out commercial and residential projects in Poland’s six largest cities – Warsaw, Wrocław, Kraków, Katowice, Gdańsk and Łódź.

Grupo Lar is an international property development company that has been operating for more than 50 years on three continents: in Europe, North America and South America.